Forex Trading

Foreign currency exchange or simply buying and selling are

known as Forex trading. There are various currency exchanges in Forex trading for various purposes and the daily average market volume of Forex trading is around 5 trillion dollars. There are three parties involve in Forex trading they are, corporations, individuals and institutions. In the past, Forex trading was open only for the millionaires but now anyone who is with at least 100 dollars can engage in Forex trading.

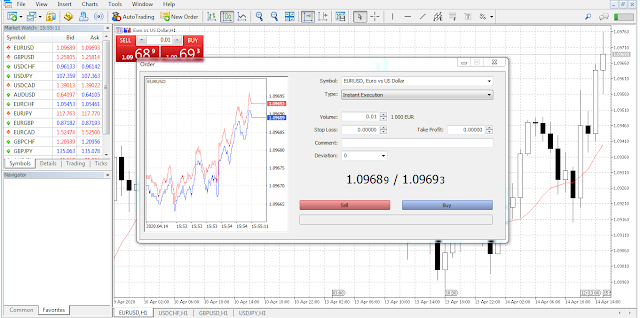

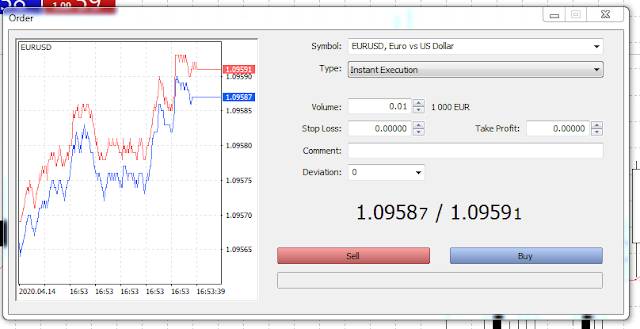

The currencies are traded in Forex trading one against another and those are called currency pairs.

The currencies are traded in Forex trading one against another and those are called currency pairs.

Forex Market

The place where the foreign currencies are exchanged is

known as Forex market, foreign exchange market or FX. This is the most liquid asset market and largest market in the world because trade, finance and commerce are operated worldwide.The currencies should be exchanged in order to perform

transactions in between countries. As you know, we should have foreign

currencies for imports from other countries. If someone needs to travel other

countries, he should have currency relevant to the particular country.

There is a high volatility of currencies in Forex market because global influencing factors such as global economy, politics, tourism and interest rates. There is always an opportunity to earn profit because when one currency is getting weak, the other one will be strong as these act as pairs.

Why Forex Market?

The currencies act as assets in Forex Trading because the difference in

interest rate between currency pairs can generate profits. Then you can invest

on currencies to earn profit. The currency with higher interest rate is bought

and the other one with lower interest rate will be sold.

In the past, the individual investors faced many difficulties when trading Forex, but the procedure is very easy now because of the technology development such as internet and networks. The individual Forex traders can access the Forex market at any time through internet. You can access the Forex market through banks and online Forex brokers who provide leverage for controlling a large volume with a small amount in hand.

Risk Associated with Forex

In the past, the individual investors faced many difficulties when trading Forex, but the procedure is very easy now because of the technology development such as internet and networks. The individual Forex traders can access the Forex market at any time through internet. You can access the Forex market through banks and online Forex brokers who provide leverage for controlling a large volume with a small amount in hand.

Risk Associated with Forex

The only market operated 24 hours in weekdays and start from Australia to New

York is Forex market. You need to have a good understanding of economies in various countries

to get a broad picture of the Forex market. The traders with small investments

are able to trade in Forex market to earn quick cash.

It is easy to earn from Forex trading but you have to be patient and do not be emotional. Because this is a currency trading therefore you need to be more careful. Forex trade can make a profit as well as loss. Therefore it is important to go through this lesson series to have a good knowledge on Forex trading.

Benefits of Forex Currency Trading

It is easy to earn from Forex trading but you have to be patient and do not be emotional. Because this is a currency trading therefore you need to be more careful. Forex trade can make a profit as well as loss. Therefore it is important to go through this lesson series to have a good knowledge on Forex trading.

Benefits of Forex Currency Trading

There are a lot of free resources of reference materials related to the Forex trading. Those are Yahoo finance, Bloomberg, BBC news, fundamental and technical

analysis reports and CNN news.

The liquidity is high in the Forex market. The currency pairs can be easily buy and sell without a large variance. The liquidity may vary according to the currency pairs. There are no any barriers for new comers. Anyone can involve in Forex trading.

You can request your income directly to your bank account for free immediately after you earned and you will receive your money within 24-72 hours.

You can trade for 24 hours a day for weekdays without any time restrictions.

There are no commissions and manipulations in the Forex trading.

The liquidity is high in the Forex market. The currency pairs can be easily buy and sell without a large variance. The liquidity may vary according to the currency pairs. There are no any barriers for new comers. Anyone can involve in Forex trading.

You can request your income directly to your bank account for free immediately after you earned and you will receive your money within 24-72 hours.

You can trade for 24 hours a day for weekdays without any time restrictions.

There are no commissions and manipulations in the Forex trading.

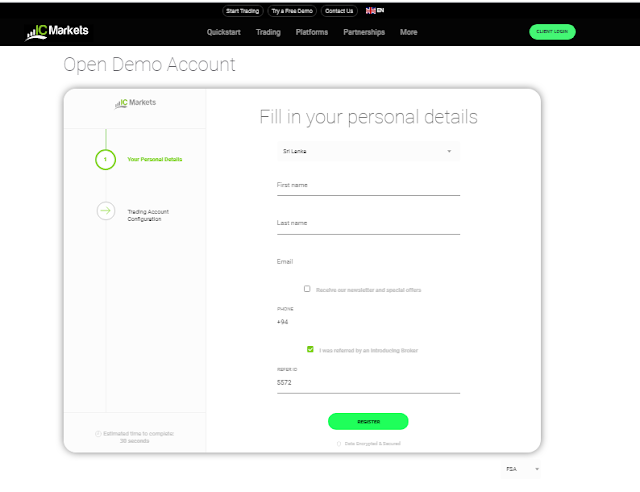

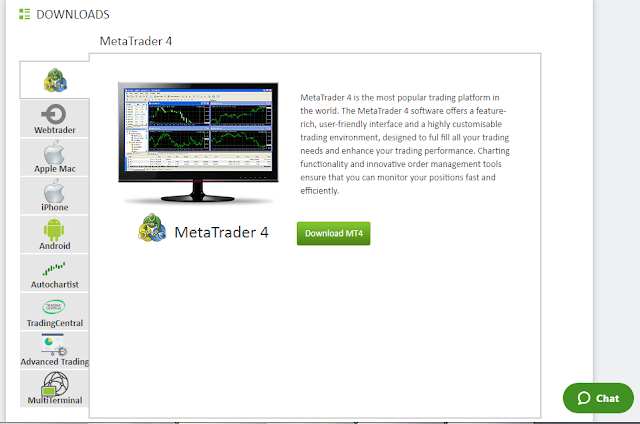

You can have training on Forex trading through a Forex demo account. When

you use a demo account, your risk is very low and you can get this service for

free. You can get the real experience of how the Forex trading is done through

a Forex demo account. Then you can gain a pretty knowledge on Forex trading. It is necessary

to use a demo account for training before you are going to invest.

You can start Forex trading with a small amount of money. But it is essential to have a proper training, good knowledge on Forex market and disciplines for you to be a successful Forex trader.

Your continuous effort, good practice and thorough knowledge are very important for Forex trading. So, study our lessons very carefully before go for Forex trading.

This is not a process of quick money earning. You have to be patient a lot to earn from Forex trading. If you are to the right process, definitely, you will be able to earn good money.

You can start Forex trading with a small amount of money. But it is essential to have a proper training, good knowledge on Forex market and disciplines for you to be a successful Forex trader.

Your continuous effort, good practice and thorough knowledge are very important for Forex trading. So, study our lessons very carefully before go for Forex trading.

This is not a process of quick money earning. You have to be patient a lot to earn from Forex trading. If you are to the right process, definitely, you will be able to earn good money.